“Made in China 2025” and “Make in India” are more than just catchy government slogans in 2025. They are the foundation of the future of global supply chains. China wants to be the leader in high-tech, and India is getting stronger with its PLI (production-linked incentive) programs. But the competition isn’t always a fight. In some important technology fields, it’s all about coming together, learning from each other, and having the same goals.

Ambitions Under the Microscope

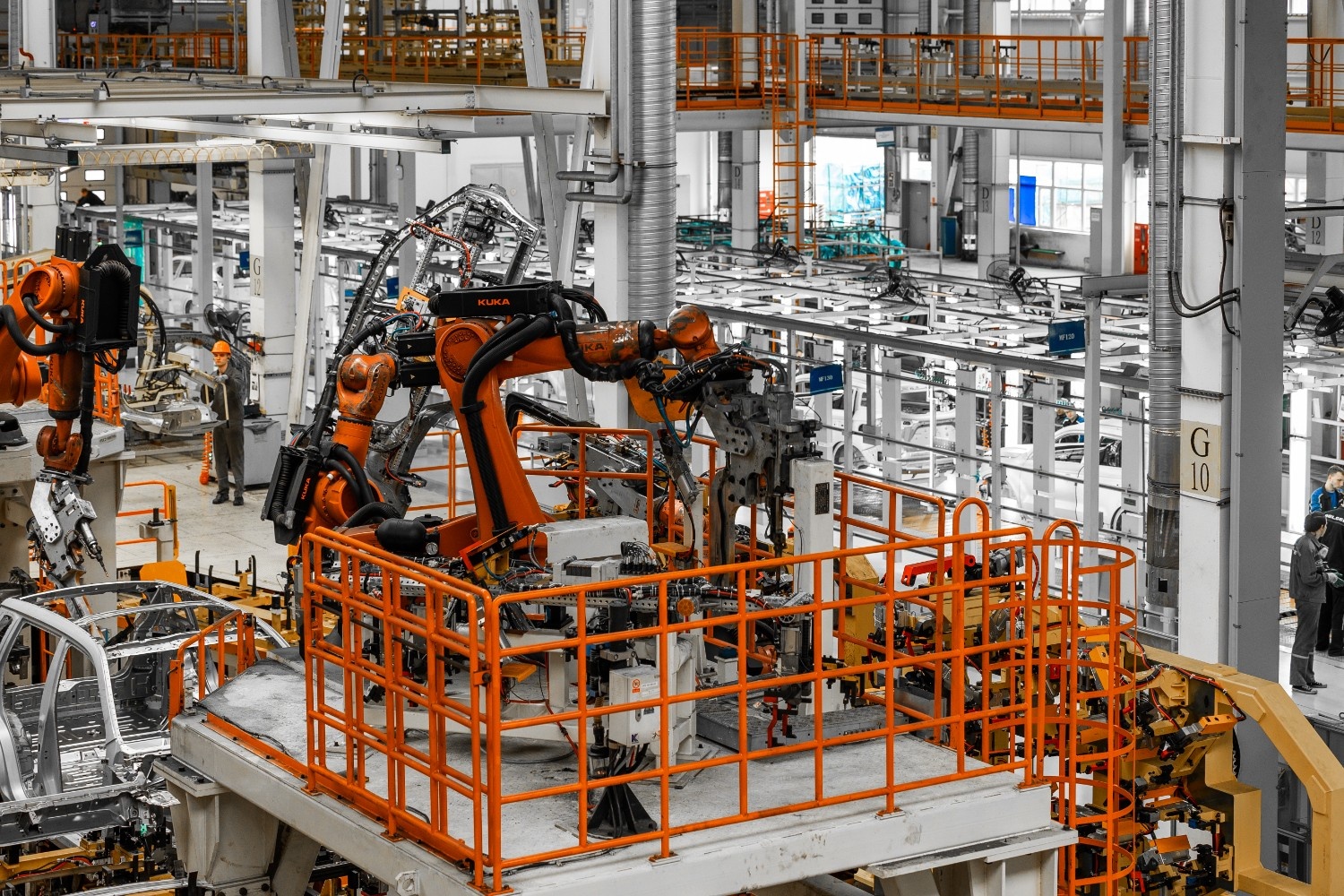

Let’s begin with what each country aimed to accomplish. China’s “Made in China 2025” (MIC2025) was unleashed a decade ago to shift the nation away from low-cost production and into high-value tech manufacturing. The vision: dominate sectors such as electric vehicles, robotics, artificial intelligence, aerospace, green energy, and semiconductors. The playbook was well-funded, clear, and long-term in focus, supported by state backing, subsidies, and a ruthless pursuit of global market share.

India’s “Make in India” odyssey started with more expansive dreams. It spread its nets wide over 25 sectors, from auto parts to medical devices. The major thrust of the past five years has been the PLI initiatives with more than Rs 1.9 trillion of focused incentives for sunrise sectors such as electronics, EV batteries, solar panels, and special steel. The idea: cut imports, increase domestic value addition, and generate manufacturing employment.

Diverging Strengths: Where Each Excels

China’s high-tech industries advanced at lightning speed. It’s the global leader in electric cars, with Tesla beaten in sales by BYD, and it makes virtually all the world’s solar panels and a lion’s share of the world’s telecom equipment. The nation’s R&D expenditures are strong, patent applications are explosive (more than 4.7 million, compared with India’s 15,000+ in 2025), and its targeted clusters, such as Shenzhen, Suzhou, and Xi’an, drive continuous innovation.

India, however, is not pursuing China in all sectors. Its largest pick-up has been in electronics assembly and shipping. In Q2 FY2025-26, India surpassed China as the leading smartphone exporter to the United States, with both local and international brands increasing their investment in production clusters in Noida, Chennai, and Bengaluru. Solar production has also leaped, assisted by tariffs and local incentives, reducing China’s dominance in India’s solar sector from more than 90% just a few years back to 56% for cells.

Overlaps and Convergence: Learning in Action

Not all Indian success is about outcompeting China on its own terms. Rather, there’s a lot of convergence, particularly in value chains. For instance, as India produces and exports more smartphones, many higher-value components, such as semiconductors and display modules, continue to be sourced from China. In pharma, India leads generic drug exports but relies on China for more than 70% of active pharmaceutical ingredients.

There’s convergence, too, in policy learning. Experts attribute China’s strong public-private research ecosystem, long-term planning, and skills drive as the inspiration for India’s moves to improve its own R&D and workforce development. Various Indian PLI schemes now draw on China’s experience with cluster integration and targeted incentives for local supply chains.

Where India Competes and Wins

Don’t confuse convergence with passivity. India is making inroads globally in areas such as IT services, governance-driven AI, and certain segments of specialty chemicals and automotive components. AI is a rapidly developing competitive space. While China leads in core research and “deep-tech” applications (such as facial recognition, smart cities, and military AI), India is leading in citizen-centric use cases and in using open-source models to localize health, governance, and agricultural solutions.

The figures support this. India has educated more than one million AI experts and seen foreign AI investment increase by 60% in 2025, driven by reliable frameworks and open regulation.

Lessons from Each Other

China’s model survives on interlinked policy, global-standard infrastructure, and extensive supply chain connectivity. India’s comparative advantage lies in open markets, a burgeoning youth population, rapid policy responsiveness, and a disposition to marry manufacturing with world-leading services. PLI schemes are beginning to take India up the value ladder. However, there is still much to learn from China’s highly integrated supply chains and R&D-oriented attack.

Both strategies offer lessons: China demonstrates the power of strategic and long-term vision, while India offers the advantages of open innovation and adaptive policy, particularly for emerging economies.

The Road Ahead: Clash or Convergence?

The most intense competition might still occur in “next-gen” domains such as semiconductors, renewables, and AI, but the tale of 2025 is one of edges blurring along the divide. Indian and Chinese businesses are already co-investing in certain sectors, learning from one another, and creating shared value chains in a world that’s becoming more regional, specialized, and interconnected.

If you’re watching the global manufacturing race, 2025 feels less like a clash in the classic sense. Instead, it’s a dynamic blend of rivalry, overlap, and even collaboration, an invitation for emerging economies to learn, adapt, and grow faster together.